The First-Time Home Buyer Savings Account (FHSA) — A Guide for Canadian Homebuyers

As a new homebuyer, you may be looking for ways to save for your first home. That's where the First-Time Home Buyer Savings Account (FHSA) comes in! This savings vehicle was introduced in the 2022 federal budget to help Canadian residents achieve their homeownership dreams.

Getting to Know the FHSA

The FHSA is a savings account designed to help Canadians save for their first home purchase. You can contribute up to $8,000 annually with a lifetime limit of $40,000. Just keep in mind that the annual contribution limit is per person, not per account. If you don't use the funds for your first home purchase, you can transfer the unused amount to an RRSP or RRIF or include it in your taxable income. The FHSA account can only be open for 15 years and must be closed by the end of the year you turn 71.

Contribution Limits

You can contribute up to $8,000 each year to your FHSA. If you only use some of your contribution room in one year, you can carry it forward to future tax years with a maximum lifetime limit of $40,000. Remember, you'll want to keep track of your contributions, especially if you have multiple FHSAs, to avoid over-contributing and facing a penalty tax of 1% per month on the over-contributed amount.

Savings with Tax Advantages

Contributions, like an RRSP, can be used to save on taxes by reducing your income. Withdrawals, including any investment growth, are tax-free as long as the funds are used to purchase your first home. This feature makes the FHSA a tax-efficient savings vehicle for first-time homebuyers like you!

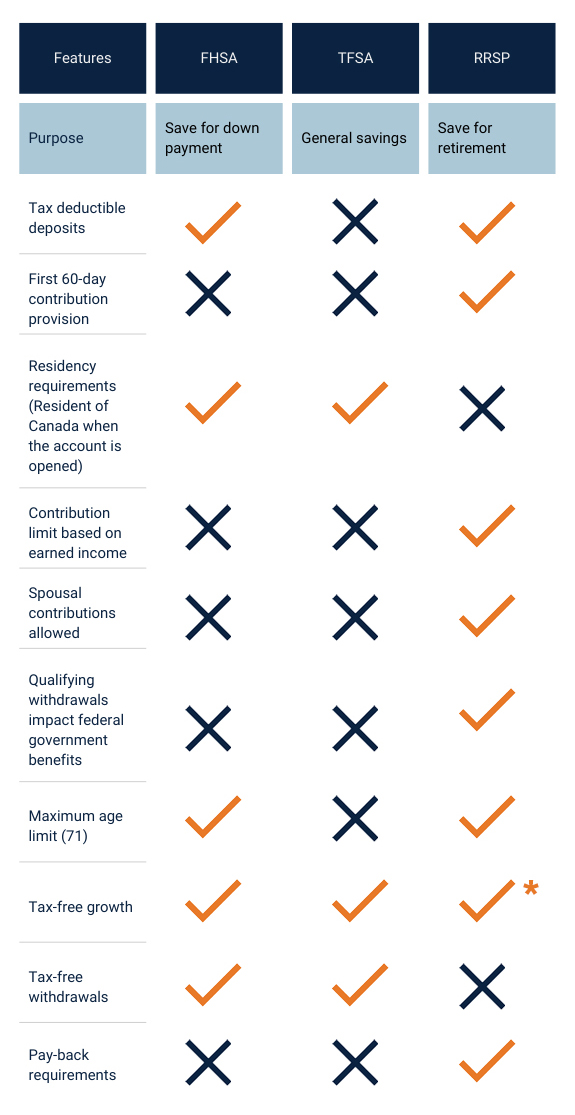

FHSA, TFSA, and RRSP Comparison

The FHSA, TFSA, and RRSP all offer tax-efficient savings, but there are some key differences:

*Any income you earn in the RRSP is usually exempt from tax as long as the funds remain in the plan; you generally have to pay tax when you receive payments from the plan.

Non-Resident Account Holders

The Canada Revenue Agency may classify you as a non-resident for tax purposes if you usually:

- Reside in another country

- Live outside Canada for the entire tax year

- Spend less than 183 days in Canada during the tax year

- Have minimal ties to Canada, such as a home, spouse or common-law partner, or dependents

If you become a non-resident while owning an FHSA, your account can remain open, retain its tax-free status, and you can still make contributions. However, you won't be eligible to make a qualifying withdrawal. Withdrawals by a non-resident will be subject to withholding tax.

The FHSA is a helpful tool for Canadians looking to buy their first home. With its contribution limits and tax advantages, it's a convenient way to save for your down payment. You can always stay up to date on your FHSA contribution room by checking "My Account" or "My CRA" on the CRA website or by calling the CRA's Tax Information Phone Service at 1.800.267.6999 (TIPS).

Let's get started.

Complete our Contact Form and we will notify you when this investment account is available to our members!

Search

Search